The following is an excerpt from the State of IoT publication from the Indiana IoT Lab – Fishers. Download the report in its entirety at theStateOfIoT.com.

The smart home market, its challenges and opportunities, and a look into the future.

It is important to first define the “smart home.” As in most cases, how you define it drives how you view it. A “smart home” is intuitive, aware, reactive, empathetic, seamless, and adaptable. It’s a big promise offering convenience, the ability to eliminate mundane tasks, and anticipation of the family’s needs. While the smart home has not yet been delivered, it is closer and headed in the right direction, encouraged by the mainstream attention companies like Amazon, Google, and Apple have brought to a mass market hungry for innovation.

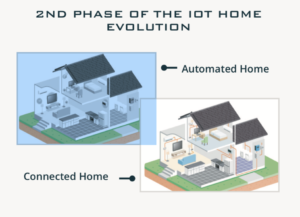

We are now in the second phase of the IoT home evolution, having moved from an automated home to a connected home. Initially, home automation was primarily envisioned by early adopter tech fanatics who cobbled their own system together using products and proprietary user interfaces (touch screens, wall-mounted master controls or tablets and smart phones) to bring it  together. Often hardwired, sometimes wireless, the automated home was always complicated, driven with push buttons to “set the scene,” and outdated the day it was installed. The automated home was composed of several single-use smart devices, including IoT-enabled thermostats, garage door openers, and locks which primarily functioned on their own through an app. As home automation devices have gained popularity, attention has turned to creating a connected home, aided by user-friendly interfaces, voice assistants and mobile applications, with more affordable and intuitive single-use products.

together. Often hardwired, sometimes wireless, the automated home was always complicated, driven with push buttons to “set the scene,” and outdated the day it was installed. The automated home was composed of several single-use smart devices, including IoT-enabled thermostats, garage door openers, and locks which primarily functioned on their own through an app. As home automation devices have gained popularity, attention has turned to creating a connected home, aided by user-friendly interfaces, voice assistants and mobile applications, with more affordable and intuitive single-use products.

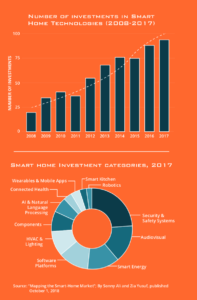

The residential Internet of Things (IoT) industry is certainly making progress but not yet delivering on the full promise of the IoT. However, venture investment, consumer acceptance, and commitment from both existing manufacturers and new entrants, point to fully realized smart homes in the near future. Investments into the smart home market –the lifeblood of innovation – are at record highs. As the chart in the top right indicates, the number of venture investments in global smart home technology has grown at an exponential rate over the past decade. In 2017 alone, there were almost 100 deals in this tech category. As you see in the bottom right chart, security and safety has become the largest category for investing. This investment is driving more innovation and resulting in smarter products. Homeowner acceptance, expectations, and desires for a smart home are rapidly growing globally. In our category, Schlage was an early leader in global security solutions for the IoT with products like Schlage Connect, Schlage Sense, and Schlage Control, while other Allegion brands, acquisitions (AXA and Milre), and investments (Yonomi, Nuki and Conneqtech) have further expanded its international footprint.

This appetite creates demand, which creates change and new opportunities:

- Incumbent brands are innovating and iterating, now entering the second, third, and fourth generation of their hardware and software solutions. Increasingly later-generation products are incorporating newer and better technology at the edge (radios and processors) which makes devices faster, smarter, and easier to use, and provides a better all-around experience.

- Startups are showcasing innovative and unique approaches, and their “art of the possible” inspires even more innovation from their peers.

- Mega-tech entrants, like Amazon and Google, are bringing new ideas, challenging the status quo and creating approachable home control via voice assistants.

- Cloud-based computing and well-defined APIs are helping companies work collaboratively, better, faster, and more purposefully; these alliances are easing barriers to integration, which will allow single-use smart products to create the smart home.

- In the new construction market, home builders are realizing smart homes and media exposure provide differentiated marketing value, and those who cater to homeowner demand are realizing increased sales and margins. Getting to the last mile of a truly smart home is within reach, poised for widespread adoption and integration. Momentum is in the favor of smart homes, provided the IoT industry can deliver and solve for these six factors:

1) Value creation. The “cool factor” was fine when it was a single-use device on its own, but homeowners want use cases to drive real value when it comes to a smart home. They want their home to be intuitive (it knows it is me); aware (it knows I am in the kitchen); reactive (it knows it’s dinner time and asks if I want to turn the oven on); empathetic (it knows I like to listen to my meditation app to relax when I get home); seamless (security system is disarmed when I walk up, the door locks behind me, lights turn on, and the temperature goes to 70 degrees); and adaptable (the home knew I was out of eggs, has permission to order them from the grocery store and deliver into my fridge, and notified me that my home was secured afterward). That’s a smart home. That’s a smart home delivering value to a homeowner. The question is how quickly ecosystems can come together to deliver on this potential value.

2) Connected versus smart devices. In reality unlike the smart home described above most of the “smart” devices on the  market are just connected. Step 1 in making the smart home

a reality is creating truly smart devices. The current default design focuses more on how devices are controlled via an app, rather than how they work within ecosystems, and are controlled by third-party interfaces. As more computing power gets introduced to the devices themselves (also known as “the edge”) and combined with the power of the cloud, the result will be true smart devices. This will work itself out as innovation continues. It is a case of when, not if. It is just going to take time and effort.

market are just connected. Step 1 in making the smart home

a reality is creating truly smart devices. The current default design focuses more on how devices are controlled via an app, rather than how they work within ecosystems, and are controlled by third-party interfaces. As more computing power gets introduced to the devices themselves (also known as “the edge”) and combined with the power of the cloud, the result will be true smart devices. This will work itself out as innovation continues. It is a case of when, not if. It is just going to take time and effort.

3) Trust and security. Consumers are weary of cyber-security attacks, hacking, and mismanagement of data; they demand smart home solutions be both secure and convenient. As the industry matures, the bar will be raised: First, by an increasing number of reputable brands and solutions that deliver consistently; second, by legislation and codes to govern responsible application of technology; and third, by homeowners who are more educated on how the products they bring into their homes protect them and their privacy (and how they can protect themselves).

4) Inconsistent experiences. Consumer expectations are high, and they should be. Unless products work together and create use cases that homeowners rely on for daily living, the long-term adoption rate will be artificially limited. The good news is manufacturers recognize this, are working closely together and, when inconsistencies happen, are proactively and sometimes predicatively notifying, addressing, and fixing them. This part, frankly, is hard and will not be 100-percent avoidable. But we can design products with best practices, test them to find bugs in the lab versus in the field, have processes in place to address problems, and implement many more approaches reducing the likelihood of negative consumer experiences.

5) Lack of standards, legacy technologies and purpose-built products. The desired utopia is one where the smart home has a standard operating system all devices work with and use to communicate. Unfortunately, it is not going to happen. What will happen is segmentation and narrowing of the many different protocols driven by mega-techs and the technology delivering the use case (e.g., Amazon, Google, etc.) and go-to- market strategies supporting the business case (e.g., Comcast, Alarm.com, etc.). In the end, the prevailing protocols are Wi-Fi, Bluetooth, Zigbee, and Z-wave. There will be others, but for the foreseeable future (which is dictated by the past primarily), this is what we have.

6) Price. As outlined in research by McKinsey & Company (“There’s No Place Like Home”), in order to gain widespread adoption, devices and the systems that bring them together need to be more affordable and extend beyond just the hardware and software costs to include third-party installation and configuration. The underlying system needs to be affordable. That said, manufacturers and service providers that go beyond the cool factor are finding new revenue streams from value-added services. For example, new business models are being introduced where hardware costs are offset by monthly service fees (in some cases, manufacturers are going direct to homeowners who see value in the data), as well as models with a monthly fee subsidizing all of the hardware (manufacturers are becoming service providers to homeowners).

So, when will the smart home become a reality? With the speed of innovation, investment dollars pouring in, businesses finally seeing the smart home as differentiation and a land-grab opportunity, and a consumer more ready and willing than ever, the future of a true smart home is not too far away. What we have today (0-12 months) is a connected home. What we will have tomorrow (12-24 months) will be smart devices. And what we have in the future (24-36 months) will be the smart home. As they say, “The past cannot be changed. The future is yet in your power.”

Find out more – www.allegion.com

Arabic

Arabic Chinese

Chinese Dutch

Dutch French

French German

German Hindi

Hindi Italian

Italian Japanese

Japanese Korean

Korean Portuguese

Portuguese Russian

Russian Spanish

Spanish